Why pays to diversify your portfolio internationally

Home bias is a very real thing. Unfortunately, investors commonly exhibit a tendency to prioritise domestic investments over international ones, potentially leading to a detrimental impact on portfolio performance over the long run.

This phenomenon arises from familiarity with local markets and a sense of comfort with domestic assets, leading investors to overlook potentially lucrative opportunities abroad. However, by concentrating investments in a single market, investors become more susceptible to country-specific risks such as regulatory changes, economic downturns, or geopolitical instability. Over the past decade, UK-focused investors may have found themselves regretting their lack of exposure to the US markets. While the FTSE 100 has seen a modest appreciation of just over 15%, the S&P 500 has surged by over 180% during the same period.

Additionally, European investors have witnessed remarkable performance in their domestic indices, with both German and French markets reaching all-time highs. This disparity highlights the potential benefits of diversifying portfolios internationally, as global markets provide varied opportunities for growth and offer a buffer against sluggish domestic performance.

By allocating funds across different geographic regions, investors can shield their portfolios from the impact of unforeseen macroeconomic or geopolitical events. By spreading investments across multiple countries and regions, investors can reduce the likelihood of severe portfolio disruptions caused by isolated incidents such as currency devaluations, government instability, or even natural disasters.

Building watchlists to identify opportunities

One excellent way to make the most of the 25 folios now available on Stockopedia is to create ‘international watchlists’. These can be used to monitor international investment opportunities which can be added to a portfolio to achieve geographical diversification.

Building watchlists can help private investors capitalise on more attractive valuations, more efficient market dynamics, or higher secular growth drivers. Emerging markets, for instance, may offer higher growth potential compared to mature economies, albeit with increased volatility and risk.

To emphasise this point, those savvy enough to gain exposure to the Indian markets over the last few years will have been handsomely rewarded. India's remarkable levels of economic growth have propelled its stock market to new heights. Its robust economic performance has translated into strong corporate earnings and increased demand for equities, thereby making the Bombay Stock Exchange one of the best-performing indexes across the world in recent years. Similarly, embracing international opportunities empowers investors to leverage favourable government policies. Japan serves as a prime example, undertaking substantial reforms to fortify its stock market and bolster investor trust. These reforms include measures to improve corporate governance, increase shareholder returns, and foster board independence and diversity. The Tokyo Stock Exchange is actively promoting transparency and accountability among listed companies, urging companies to optimise capital management and provide regular disclosures on their plans for enhancing shareholder value. This has seen the Nikkei, Japan’s leading stock market index, return to highs not seen since 1990. Moreover, geographical diversification provides investors with exposure to various industries and sectors that may not be prevalent in their home market. For instance, technology companies dominate the US market, while energy and commodities play a significant role in certain emerging economies. In the UK, financial services, mining giants, and oil behemoths tend to dominate much of the FTSE 100. By investing globally, investors can gain exposure to sectors experiencing robust growth trends and diversify their portfolios beyond traditional domestic industries.

Diversifying geographically also presents advantages in managing currency exposure. By investing in assets denominated in various currencies, investors can effectively hedge against currency risk and mitigate the effects of exchange rate fluctuations on investment returns. For instance, when Liz Truss assumed office as Prime Minister of the UK in late 2022, her unconventional economic strategy, known as Trussonomics, triggered a significant depreciation of the pound against key currencies such as the US dollar and the Euro. Those holding non-UK pound denominated shares would have been far better off during this period.

Overall, geographical diversification can be a great component of a well-rounded investment strategy for private investors. Whilst some of the larger companies in a home nation may provide international exposure, investing internationally can allow investors to harness the benefits of global economic growth, access more diverse opportunities, and mitigate the impact of localised market fluctuations.

Customisable table views

Another key element of investing internationally is the potential to benefit from exposure to different factors. By dissecting the underlying drivers of stock performance, factor investing aims to capitalise on identifiable traits or characteristics that have historically demonstrated a persistent ability to outperform the broader market. Our very own StockRanks are designed to simplify factor investing principles into actionable insights for investors and are based on the core tenets of Quality, Value, and Momentum. However, the effectiveness of factor investing can vary across different markets, with distinct factors exerting more influence in certain regions.

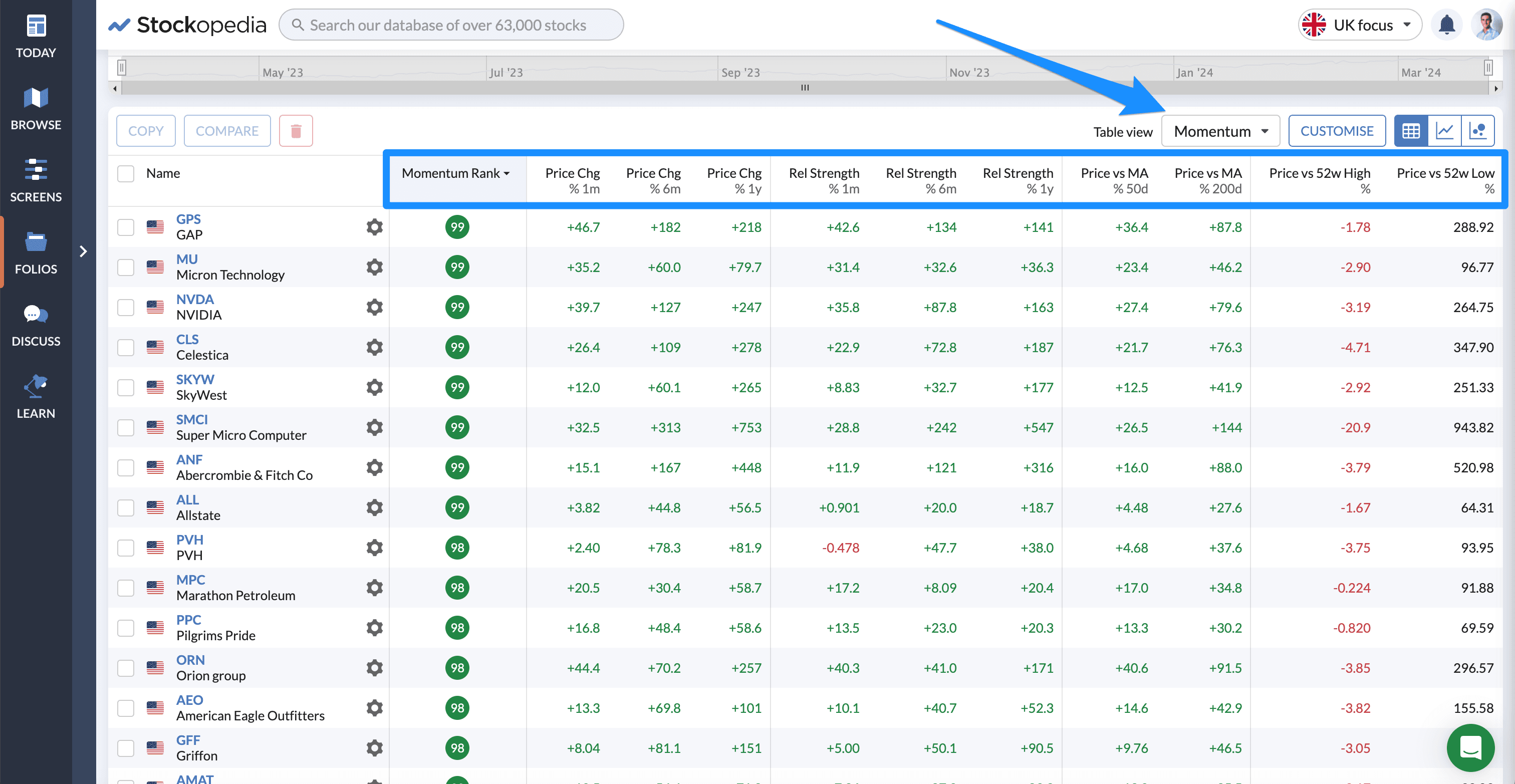

In the United States, growth and momentum investing have stood out as dominant factors driving market returns over the past several decades. Growth-oriented strategies focus on identifying companies with strong earnings growth potential, often characterised by high revenue growth rates and earnings per share. Momentum investing, on the other hand, capitalises on the tendency of stocks that have exhibited strong price performance in the past to continue their upward trajectory in the near term.

The US market's emphasis on growth and momentum reflects its dynamic and innovative business environment, where investors are eager to chase high-growth opportunities and benefit from market trends. As such, investors in the US may prioritise factors such as revenue and earnings, as well as price momentum, when constructing their investment portfolios. Stockopedia offers a range of pre-set table layouts to cater to any of these preferences, allowing investors to tailor their watchlists to the metrics that count.

Conversely, the stand-out quality in the UK driving market outperformance over the past decade has been Quality investing. Quality investing emphasises the importance of investing in companies with strong fundamentals, robust balance sheets, and high levels of profitability. In the UK market, where stability and reliability are often prized, investors gravitate towards companies with proven track records of profitability and resilience.

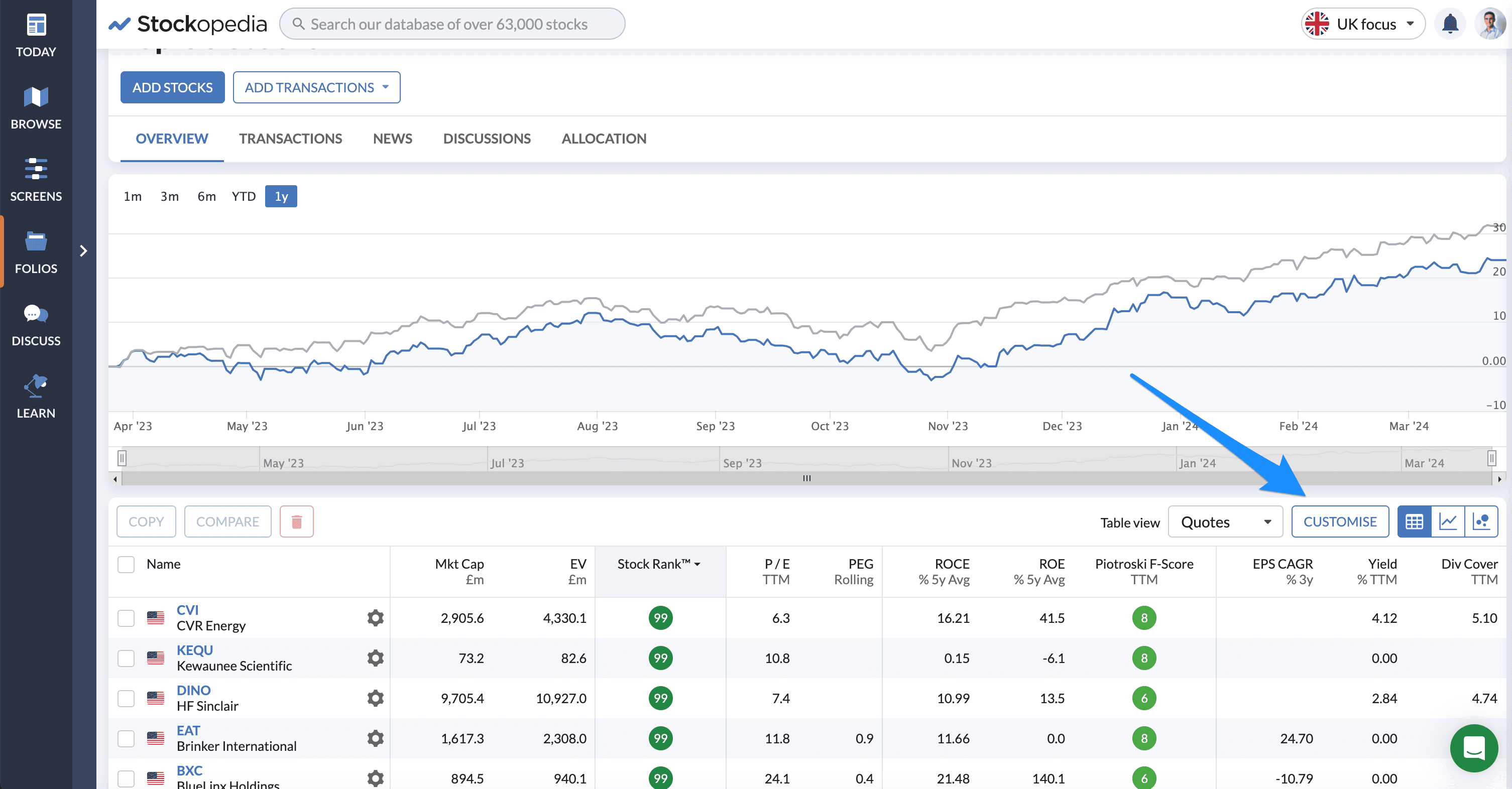

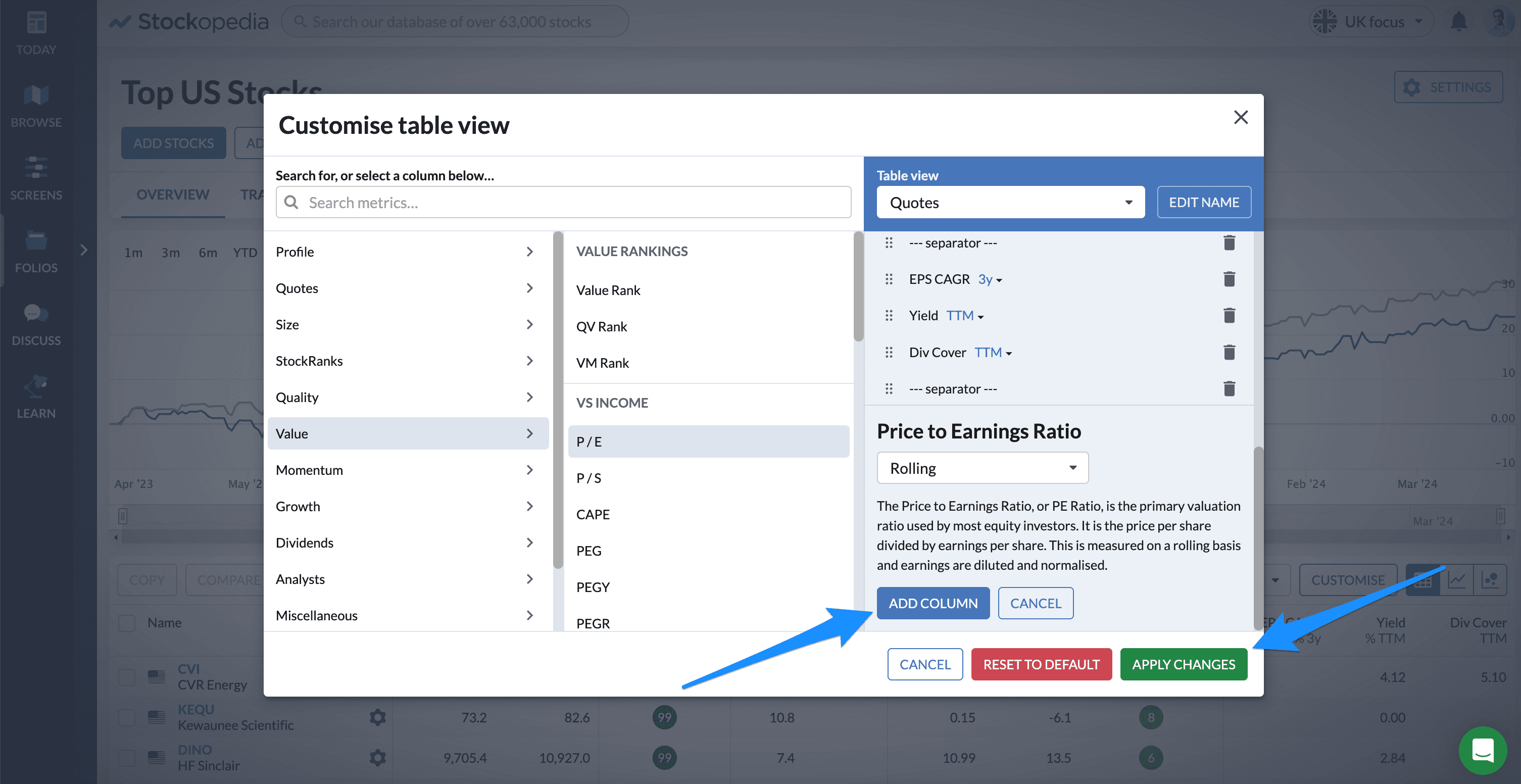

Stockopedia's customisable tables enable investors to adapt their investment approach to different markets. For UK-focused portfolios, investors may opt for layouts that emphasise quality and valuation ratios, such as return on equity (ROE), operating margin stability, and the price-to-earnings (P/E) ratio.

By leveraging the customisable tools and templates available via the screener or on your folios/watchlists, you can tailor your analysis to focus on the most relevant factors for each market.