Compounding Quality: The patient investor’s guide to stock market success

A few weeks ago, my 14-year-old brother who has just started studying for his GCSE maths exams asked me to help with with a question on compound interest. As a passionate advocate for the importance of teaching investment concepts in schools, I was delighted. Compounding is one of the most valuable lessons a novice investor can learn and (for those with a quality-first mindset) is a sure fire way of instilling enthusiasm for the power of the markets.

Compounding is often taught in the context of personal finance: investor A spends the profits from his investments every year while investor B reinvests them, after 20 years investor B has 50% more money in his portfolio. That sort of thing.

But how about in the context of business reinvestment? The principles of compounding are the same: earnings are reinvested to generate additional earnings over time. But how do businesses do that? And why are some so much better at it than others?

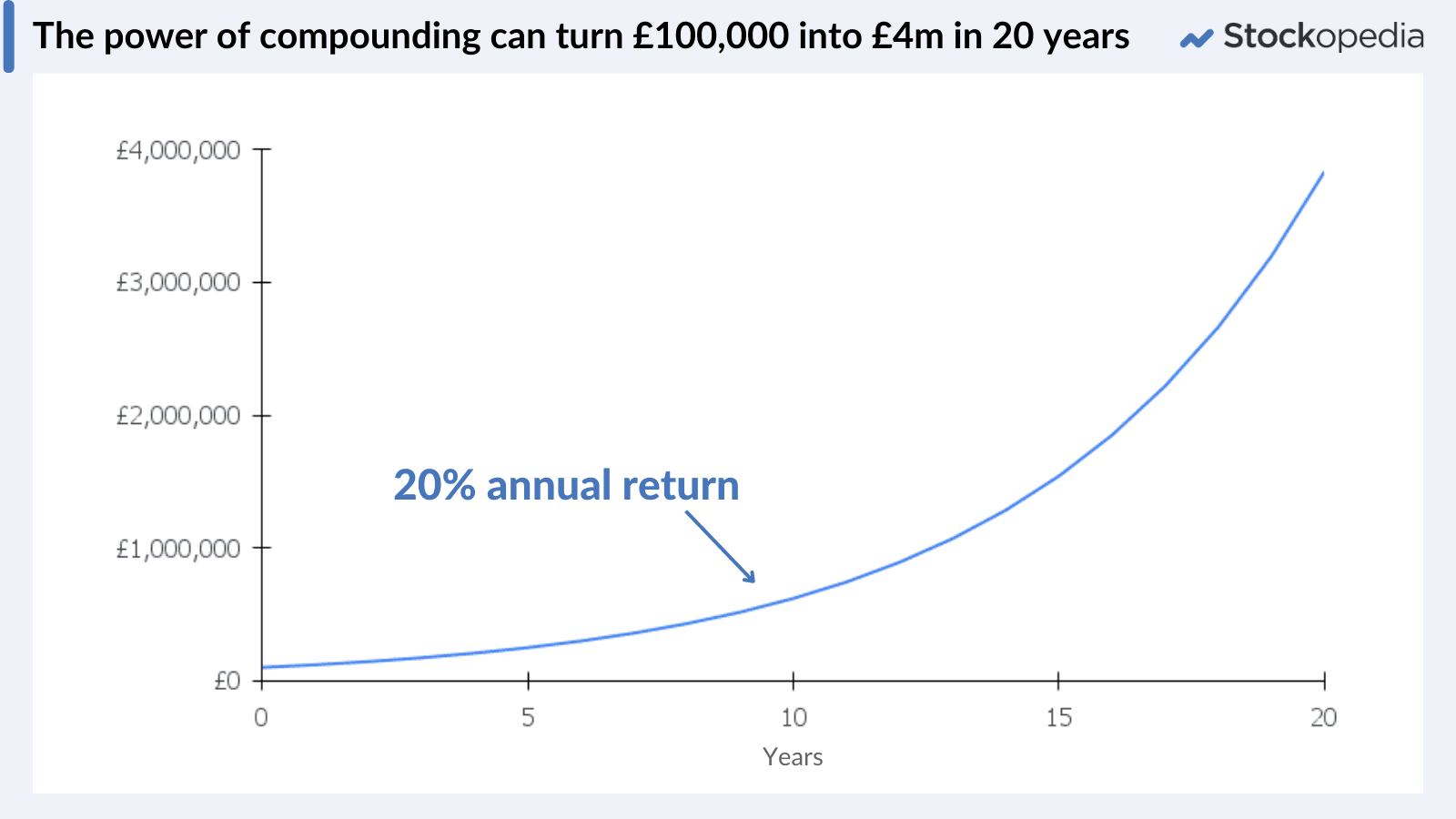

The answer lies in a company’s ability to squeeze profits from its operations. Highly profitable businesses have a greater capacity to reinvest in expanding their business. As the chart below shows, that reinvestment initially leads to a gradual increase in profits, but over time this accelerates.

When it comes to compounding, it is important to remember that lines can bend.

All of this matters because the first investment strategy we have chosen to focus in our series is Quality Compounding, which works because the reliable and enduring profitability of some businesses means they can reinvest to stimulate accelerating profitable growth.

It’s an investment strategy employed by some of the world’s most revered investors. Warren Buffett, for example, who’s “favourite holding period is forever” and Terry Smith who seeks to buy great companies, not overpay and then “do nothing.”

But employing this strategy is not easy. To build a robust quality portfolio not only requires a good understanding of the concept of compounding, but also depends on patience, diligence and discipline. This article aims to:

Help you assess whether your mindset and timeframe are suited to the “compounding quality” investment style

Demonstrate why quality compounders are the ideal stocks for patient, diligent investors

Show you how to identify compounding quality companies

Demonstrate ways to implement this strategy

Illustrate the pitfalls that investors seeking quality compounders should be wary of

Is “compounding quality” the right investment style for you?

‘Buy nice, or buy twice’, is the old adage that people like to use to justify extravagant purchases. It’s a useful framework when Patagonia has a nice jumper on sale, or when it comes to explaining the necessity of a 16-gear, Boardman road bike with disc-brakes. After all, that jumper and that bike are going to last a lifetime.

When it comes to investing, ‘buy nice’ is a similarly attractive proposition. Most investors like the idea of buying high quality shares which can generate reliable returns over a lifetime.

But can investments ever be ‘nice’ enough to last a lifetime? In other words, can the ‘buy-and-hold-forever’ strategy advocated by the likes of Warren Buffett in the US and Terry Smith in the UK actually work for private investors?

Yes, but not for everyone. Before embarking on this strategy, investors should ensure that they have the correct mindset, time frame and knowledge to make the right choices.

The approach is attractive to:

Patient investors with a long-term time horizon. If you’re going to need to take your money out of the market or if you’re likely to get impatient by slow growth, quality compounding might not be the right style for you.

Disciplined investors who aren’t likely to get scared by market fluctuations, or distracted by high-profile disrupters. Quality compounders tend to be impressive leaders in their field, not new upstarts.

Diligent investors who find companies, their business models, marketplace and management, fascinating and will put the time into researching stocks before adding them to their portfolio.

Why patient investors are suited to quality compounders

True quality compounding businesses generate greater returns for investors who are willing and able to hold on for the long run. This is because the profits generated from operations are reinvested into the business to stimulate further profits in future years. The more years that the profit and reinvestment cycle can turn for, the higher the returns for shareholders. Patience is therefore key.

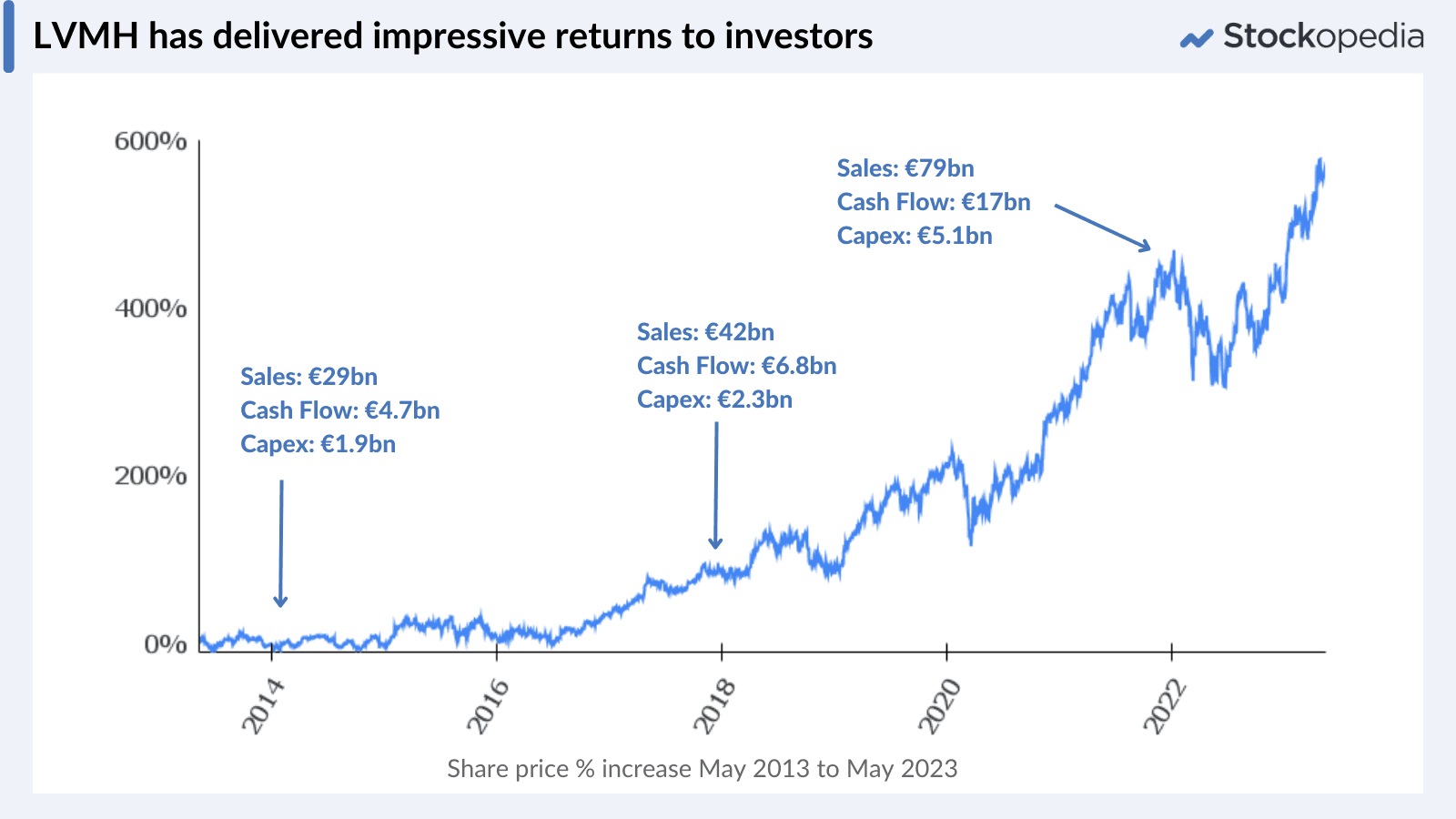

To illustrate how quality compounding works for patient investors, we’ve taken a look at the track record of French luxury goods business, LVMH Moet Hennessy Louis Vuitton.

LVMH was founded in 1980 when current chief executive Bernard Arnault merged designer clothes label Louis Vuitton and the champagne and whiskey company Moet Hennessy to create a behemoth in luxury brands. The company has grown largely through acquisition to bring 75 world-renowned luxury goods under its umbrella. These brands range from the 650 year old vineyard Domaine des Lambrays to Stella McCartney’s new environmentally friendly skincare range. They are recognisable worldwide and across generations, meaning they have a strong and enduring customer base which makes it very hard for competitors to take market share.

In the last 10 years, the strength of the brands has allowed LVMH to generate consistently growing revenues with an operating margin that has averaged 20%. Those profits have been easily converted into cash and subsequently reinvested into the business. The reinvestment has produced further profits which have been reinvested at a higher rate of return.

Investors have benefited from this virtuous circle as the share price has risen at an increasing rate to reflect the higher value business. Of course, a business like LVMH operates in huge global markets, which has been key to the sustainability of its growth. Niche compounders may not benefit from this luxury.

How to identify quality compounding stocks

Quality businesses are one thing: decent sales growth, wide margins, reliable profits, strong balance sheet - you know the drill. But what about compounding quality? These companies have a little bit of something extra, something that allows them to thrive regardless of the wider market conditions.

Guru investors, experts and fund managers have all tried to articulate exactly what it is that makes a true quality compounder investment. In Lawrence Cunningham’s book on the subject (Quality Investing: Owning the best companies for the long term), the author writes:

The best companies often appear to be characterised by an ineffable something, much like that of people who seem graced by a lucky gene.

That ‘ineffable something’ certainly seemed to apply when Warren Buffett added the US chocolate maker See’s Candies to his portfolio in 1972. His reasoning for buying the stock? The quality of the product and its its fiercely loyal customer base which he felt he could not replicate. That’s a sensible rationale, but not a universal criteria for stock selection.

The truth is that identifying the common characteristics that quality compounders share is not easy and the descriptions used by successful quality investors are often a little bit wooly. In our view, the best description of compounding quality companies are those that:

Generate reliable profits over a prolonged period that can be reinvested at a high rate of return

Tend to be market leaders with a sustainable competitive advantage (known as an economic moat) with high barriers to entry

Identifying these qualities isn’t easy, but in the sections below we will run through some of the quantitative and qualitative metrics that you can use to identify potential quality compounders.

Five financial metrics to identify quality compounders

First of all, let’s take a look at the financial metrics you need to know to identify compounding quality stock winners.

Return on Capital Employed (ROCE) greater than 20% - ROCE measures the additional operating profit generated per £ invested in the business. The higher the number, the greater the company’s ability to generate profits from its investment. Return on Invested Capital (ROIC) and Return on Equity (ROE) are other useful ratios to assess the ongoing efficiency of a company’s profitability. Investors hunting for true quality compounders should look for companies with a ROCE or ROIC significantly higher than the cost of financing. It’s essential to monitor the trend in ROCE over time - has the company been able to reinvest profits and sustain its high profitability?

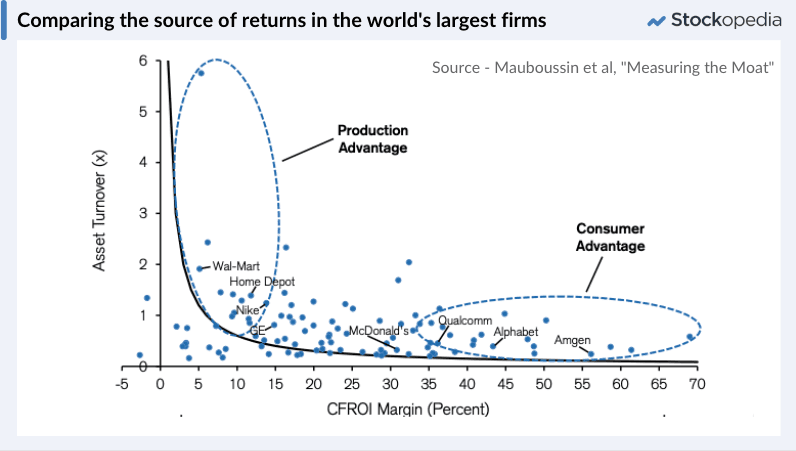

Consistently strong profit margins - Operating, Pre-Tax and Net Profit Margins demonstrate how much money a company can generate from its sales. Margins that are sustained over a long period of time through both strong and weak sections of the market cycle help to identify quality compounding companies. Be careful to compare company margins to peers in the same sector as some industries lend themselves to higher margins than others. As the graphic below illustrates, companies that sell more stuff (high asset turnover businesses like retailers) can have lower margins, but may still sustain high returns on capital.

Operating cash conversion greater than 100% - A company’s ability to convert profits into cash flows is crucial to its ability to reinvest for further growth. Investors should be looking for companies that can convert more than 100% of net profits into cash consistently.

Consistent revenue growth - Quality compounders don’t have to generate growth that sets the world on fire, but they do generate consistent, reliable, above inflationary sales growth. When this revenue growth comes alongside high margins and strong cash conversion, profits can be reinvested at a higher rate of return to spur further sales growth in subsequent years. Search for companies with a positive compound annual revenue growth rate over five years.

Net gearing of less than 50% - Gearing is a measure of a company’s indebtedness compared to its equity. It’s a good measure of balance sheet health and indicates whether a company is over-reliant on borrowings. A healthy business will have net gearing of less than 50%, while those with net gearing of over 100% are best avoided.

Going deeper: Four qualitative characteristics for when the numbers aren’t enough

These financial metrics are a good starting point. But for stock pickers looking for buy-and-hold forever stocks, these metrics aren’t enough. Investors should seek to understand the history, business model and management style before having the confidence that they are true quality compounders.

The list below provides some ideas of qualities to look out for in these stocks:

Competitive advantage - In order to be able to sustain growth over a long period of time, companies must have a substantial competitive advantage over their peers. That may be a strong brand (think Nike and Adidas in the athletic apparel industry), an impressive network effect (such as Alphabet’s owner Google), a protected technological advantage (pharmaceutical companies) or an enormous, loyal customer base (Mastercard and Visa). These qualities are known as an economic moat, which protects the company from competition.

Management efficacy - Management decision making (especially when it comes to the allocation of capital for profitable growth) can give investors a decent idea about a stock’s quality. Experienced leaders whose incentives align with company performance are a good sign. But it is also important to remember Warren Buffett’s words of wisdom on the subject - good management alone is not enough to rescue a terrible business.

When a management with a reputation for brilliance tackles a business with a reputation for poor fundamental economics, it is the reputation of the business that remains intact.

Sector analysis - What sector is the company in and how does it compare to its peers? These are the types of questions that investors hunting for quality compounders should be asking. To be able to generate reliable profits year after year throughout different stages of the market cycle, these businesses should be leaders in their respective fields with a dominant market share.

The Lindy Effect - Some companies own products or services which are so ubiquitous that their usage becomes habitual. Over time these habits can become strong enough to create what is known as the Lindy Effect, which states that the longer a company, product or brand has survived, the more likely it is to survive in the future. It is however worth noting that not all businesses are immune from technological disruption - remember Kodak and Blockbuster?

How to implement the quality compounding style

For some investors, especially novices, the need for in-depth stock-by-stock analysis can be a barrier to this style of investing. And it’s true that real quality compounders are rare - careful research is required and even then, it is unlikely you will have identified a stock to buy-and-hold forever.

But if you have the right mindset and the capacity to put the time in, the hunt for true quality can be great fun. The sections below offer three different ideas to implement this strategy.

Level 1: The idle investor’s guide to building a compounding quality portfolio

For investors without much time to do careful research, Stockopedia has built a Ranking Tool to help you identify the highest quality companies in different markets. To use this tool simply set up a screen which filters for companies with a Quality Rank greater than 80 or use the screen that we’ve already made for you. Once your screen has generated a list, build your portfolio by selecting the highest ranking stock from each of the 10 sectors (this is to ensure diversity).

Your portfolio may need to be assessed and rebalanced annually to make sure it still includes the high quality companies. If you are an idle investor you may not have done the work to ensure you own sustainably high quality businesses.

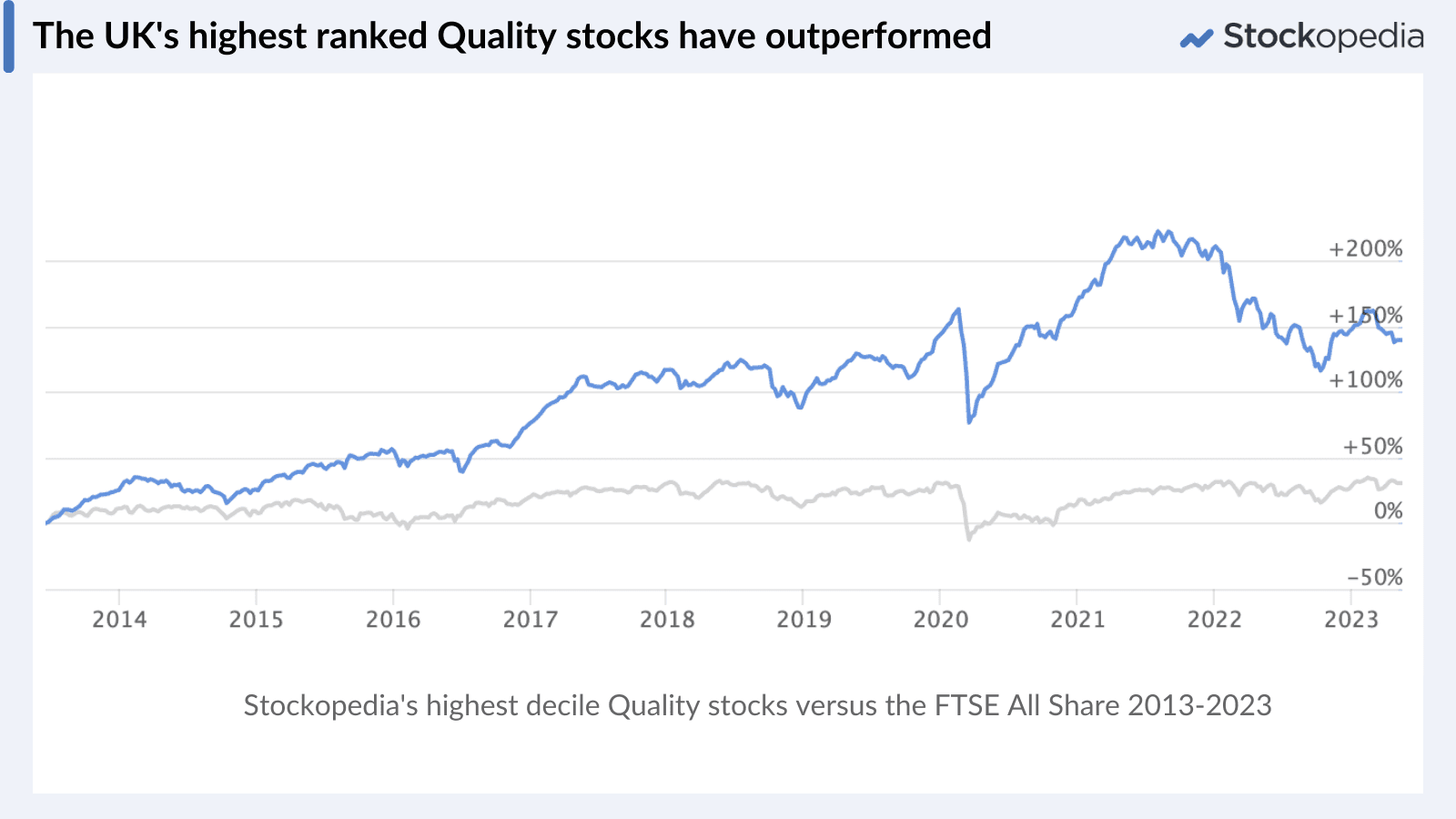

The chart below shows the outperformance of the highest ranked Quality stocks compared to the FTSE All Share:

Quick hints for the idle investor:

Think about restricting your screen to only stocks with a market cap over £50m - micro-caps can be risky

There might be sectors you want to avoid - that’s fine, but make sure you have diversified across at least five of the stock market sectors when you build your portfolio

If you’re feeling more adventurous consider building your own screen to identify stocks for your long list. Our library of screens can help give you some ideas.

Level 2: The stock-pickers guide to building a compounding quality portfolio

Use a screen to build a long list of companies which hit the financial criteria of a quality compounder - the market is home to many stocks, so screening is a good way of narrowing down your starting point.

Stockopedia has a list of screens built by quality investing gurus which can help you build your initial list of stocks. Alternatively you can build your own screen using the ratios shared by quality companies listed above.

Once you have your long list of potential companies, start your research. Look at annual reports and interim statements to check the company is growing and reinvesting its profits in a sensible way - flag any potential queries. Browse the company’s website to understand the business model and search for reviews of the company’s products or services - do the customers seem happy? Try to talk to management or if that’s not possible, look for interviews that they have given to journalists or other investors - ask for clarification on any red flags.

Stocks that you’re happy with can be added to your portfolio. Remember that for a quality investor, and if you have truly selected enduringly profitable companies, valuation is a lesser concern. Or, as Warren Buffett once said: “It is better to buy a great company at a fair price than a fair company at a great price.”

Quick hints for the stock picker:

Use screens to narrow down the field for stock selection

Don’t get too attached to the stocks in your portfolio if the fundamentals deteriorate - attachment bias can be the downfall of the quality investor

Remember that not many great stocks stay great forever - continue to monitor the stocks in your portfolio to make sure the investment case holds true

Level 3: Buy-and-hold forever like Buffett

For experienced investors managing large portfolios, the temptation might be there to try to emulate some of the great fund managers and buy stocks to hold forever or at least for a few decades. Before attempting this strategy it’s important to remember that investors like Buffett are highly experienced and often have big teams of researchers. Of course, the private investor can “piggy back” these research brains by monitoring the new holdings of well known “quality compounding” fund managers. Investors that followed Buffett’s lead by buying Apple in Q1 2016 have returned more than 7x their investment.

Quick hints for the buy-and-hold forever investor:

Question management about any uncertainties you might have with the stock

Reinvest the dividends you earn from the company - this will add to the compounding

Research the wider market to assess for competition

Quality Compounding: A style for any market?

Investors who buy companies to hold forever should be comfortable hanging on through all stages of a market cycle. Selling during a period of turbulence (either through panic or a desire to free up capital to deploy into better value stocks) can be costly.

The good news is that quality stocks do tend to hold up relatively well during periods of market uncertainty. Throughout history, periods of turbulence have been met with resilience by the highest quality stocks in the market.

Five pitfalls for the patient investor to sidestep

But beware the pitfalls of quality investing:

The value dilemma

As Terry Smith says, it’s important not to overpay for great businesses. But what is overpaying? Some great businesses deserve higher valuations than their peers because they can generate reliable returns for their investors. Others never fall to valuations which could be designated as ‘cheap’ compared to their peers. If a company is a true quality compounder, valuation shouldn’t matter that much because the virtuous circle of higher profits will keep churning out returns for disciplined investors.

This leads onto pitfall number two…

The timing dilemma

Investors who are waiting for a more attractive valuation in a quality company, might be waiting a long time. Take our example from above, LVMH. In the last five years, the stock has rarely traded under 30 times forecast earnings (a high valuation even for a high quality company), but in that time its share price has risen 200%. Anyone waiting for a more attractive entry point has missed out on some major gains.

If you’re the kind of investor who gets hung up on valuation, you might be more suited to the contrarian quality style of investing, which seeks to buy quality companies during periods of decline.

Failing to notice when a stock’s fortunes change

Inherent behaviours and psychology impact all investors regardless of what style they prefer, but one can be especially pervasive for quality compounders: attachment to the stocks in your portfolio. The idea with a quality compounding portfolio is to buy and hold a stock forever and some investors can find it very difficult to identify when something has changed in the investment case which means that stock is no longer one to hold-forever.

High profitability can revert to the mean

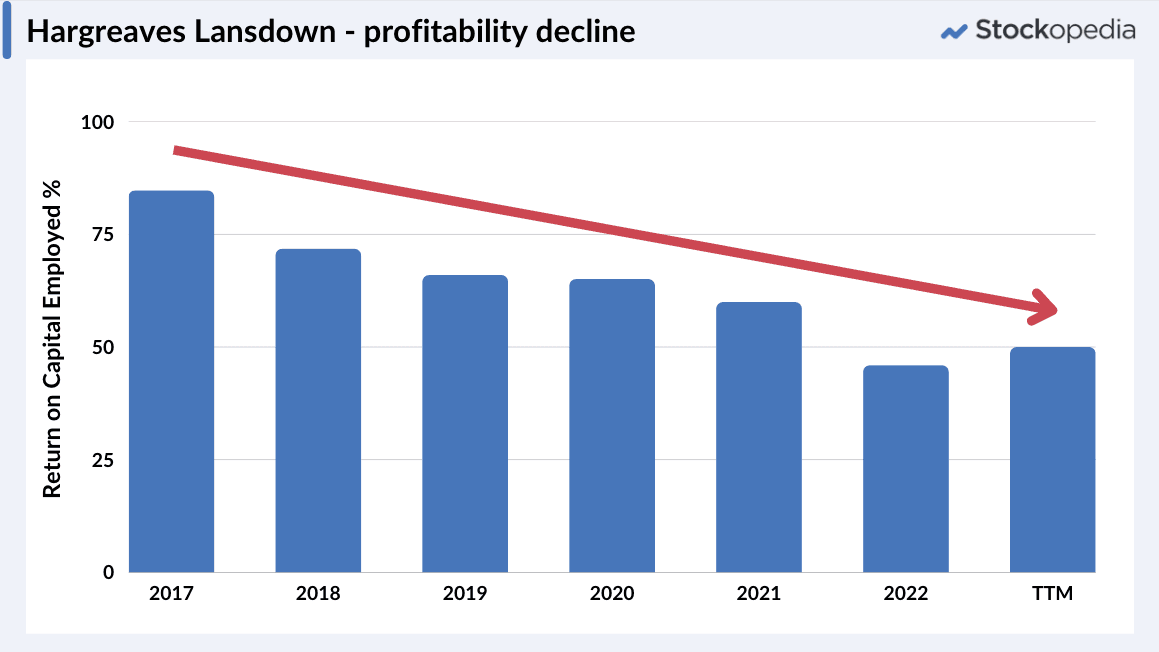

Quality stocks are also impacted by what’s known as “mean reversion”. In competitive markets, high profitability catches the eye of competitors, and invites competitive investment. This makes it tough for great companies to stay great forever as profit margins come under attack. In the UK, one of the great compounders as a private company was Hargreaves Lansdown, but since listing its return on capital has continuously declined as competition has nibbled away at its market position. The challenge for investors is that when profitability is found to be unsustainable, the valuation of the stock is likely to suffer.

The mature stage of quality companies - when quality stocks mature, perhaps due to reaching the limits of their market size, it is likely that they will no longer have good internal uses for their free cashflow. This period may see the valuation suffer as investors no longer prize the growth potential. Well managed businesses in this stage will return their free cashflow to investors as dividends. Of course, if you have bought well, the annual dividend income could be multiples of your initial investment, which you can reinvest into other new compounding stocks.

As with all styles, the key to success is commitment. In theory, the strategy works, so if you’re able to put the time in to put it into practice properly, you should see success. But if you’re struggling to commit to one style, it’s ok to take a more flexible approach - some strategies are more suited to certain points in the market cycle and perhaps you’ll find that your psychology is more suited to switching. In the following weeks we’ll be running through all of the strategies in our compass to help you make the most informed decisions.

Recommended Reading

Investing for Growth - Terry Smith

The Life, Lessons and Rules for Success - Warren Buffett

How to Pick Quality Shares - Phil Oakley

Quality Investing: Owing the best companies for the long term - Lawrence Cunningham

Measuring the Moat - Michael Mauboussin